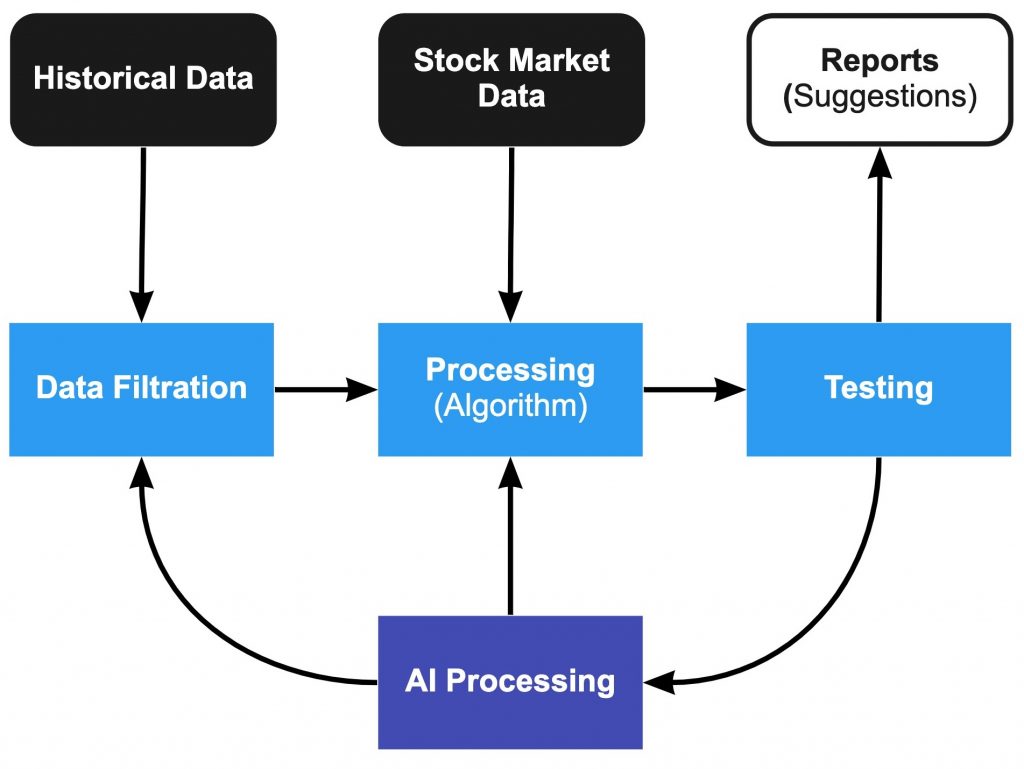

The principles of work for Stocks and Crypto investment portfolio recommendations are similar (but not identical): Adventum uses Historical Data and Stock Market Data as inputs for the forecast.

Before the processing, the input data pass the filtration stage. The goal of this stage is to prevent the Algorithm from the processing:

- tickers that have been withdrawn from the market

- tickers that have insufficient data (lack of data or they are just recently appeared on the market)

- classes of tickers that are not available for common investors

The Processing module is the heart of the project. It contains the Algorithm – a unique specially developed mathematical model, which is responsible for the recommendations themselves.

After the processing is done, the results have automatic testing and post-processing. The result of this stage is a PDF report with a recommended investment portfolio.

The AI Processing module manages all parts of the algorithm. It forms a feedback loop, which is responsible for the core Algorim features and fine-tuning of hyperparameters for the data filtration and processing itself.

The project does all the operations on its own: from obtaining the data via the API to the PDF report generation. This completely eliminates the influence of the human factor: subjective and emotional assessments, judgments and private opinions.